Have you ever wondered how a single misstep in customs documentation can disrupt your entire supply chain?

In the Philippines, the stakes are high. In 2024, the Bureau of Customs collected PHP 931.046 billion in revenues, underscoring the crucial role of customs compliance in the national economy. However, it also generated PHP 172.019 million from auctions of forfeited goods, highlighting the financial consequences of non-compliance.

The customs clearance process is intricate and consists of several stages that require precise coordination to avoid delays and errors. Each stage involves specific documents, and missing even one may lead to customs penalties or shipment delays. Moreover, a minor oversight can cause penalties, delays in shipments, or possible legal consequences.

Customs clearance is the process of ensuring goods meet all regulatory requirements before they can enter or exit a country. It involves preparing and submitting documentation, assessing duties and taxes, and obtaining approval from customs authorities

Whether you’re importing products for your online store or exporting items to customers abroad, customs clearance ensures your shipments comply. It ensures that all goods meet legal and logistical standards to avoid issues at the border. Without it, goods may be delayed, returned, or seized, resulting in financial loss and unhappy customers.

Now, let’s move on to understanding the penalties businesses might face for not complying with customs regulations.

Customs penalties are financial or administrative sanctions imposed by a country’s customs authority for trade violations. This includes the Philippine Bureau of Customs (BOC), which oversees import and export violations and enforces trade rules. These penalties may result from infractions such as misdeclaration, incorrect valuation, or fraudulent documentation errors. Using the incorrect Harmonized System (HS) codes or failing to obtain permits can also result in penalties.

Depending on the severity, penalties may include fines, seizure of goods, or suspension of the importer’s accreditation. Customs penalties enforce trade integrity, recover revenue, and ensure that cross-border transactions comply with laws and international standards. For global trade businesses, compliance helps avoid delays, penalties, and operational disruption. It also protects against unexpected costs and long-term reputational damage with customs authorities.

Also Read: How to Reduce Logistics Costs: Effective Strategies

Whether you’re a first-time importer or expanding your online business, understanding the customs clearance process in the Philippines is crucial. It ensures that your shipments meet legal requirements and move efficiently through the supply chain without delays or penalties.

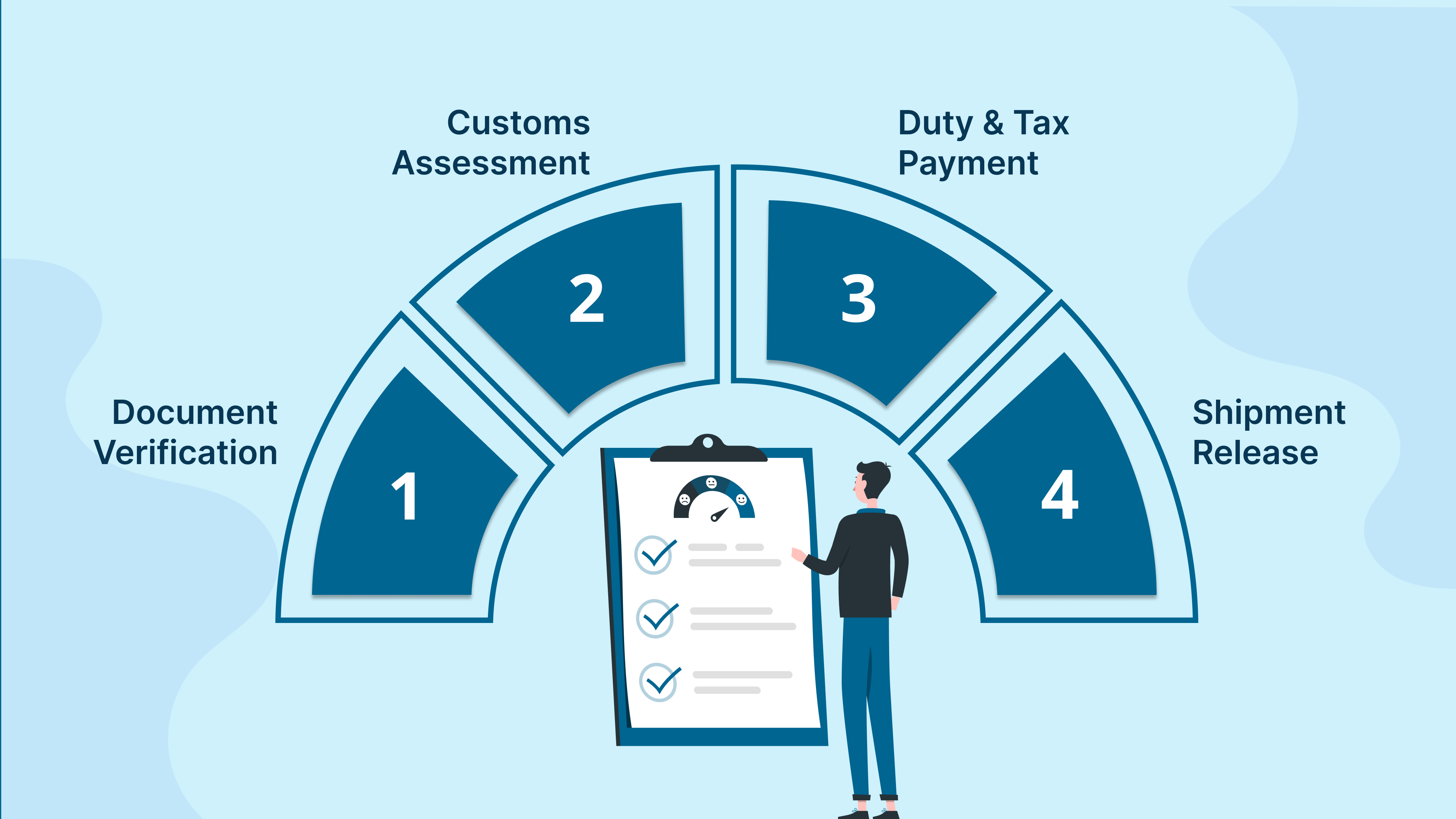

Here’s a breakdown of the three essential stages involved in clearing goods through Philippine customs:

The first step in customs clearance is preparing and submitting the required documentation to the Bureau of Customs (BOC). Each shipment must be backed by complete and accurate paperwork, which allows customs officers to verify its legitimacy and compliance with national regulations.

Below are the most commonly required documents for import and export transactions:

These documents must be submitted through the Electronic-to-Mobile (E2M) system, which streamline customs transactions and facilitates seamless customs clearance.

Once the documents are accepted, customs authorities evaluate the contents of your shipment. This includes:

In April 2025, imports accounted for PHP 611.52 billion, or 60.3% of the Philippines’ total external trade. This high volume underlines the importance of an efficient and accurate assessment process.

Shipments are also classified under a selectivity system:

Understanding this system helps you anticipate potential delays and prepare accordingly.

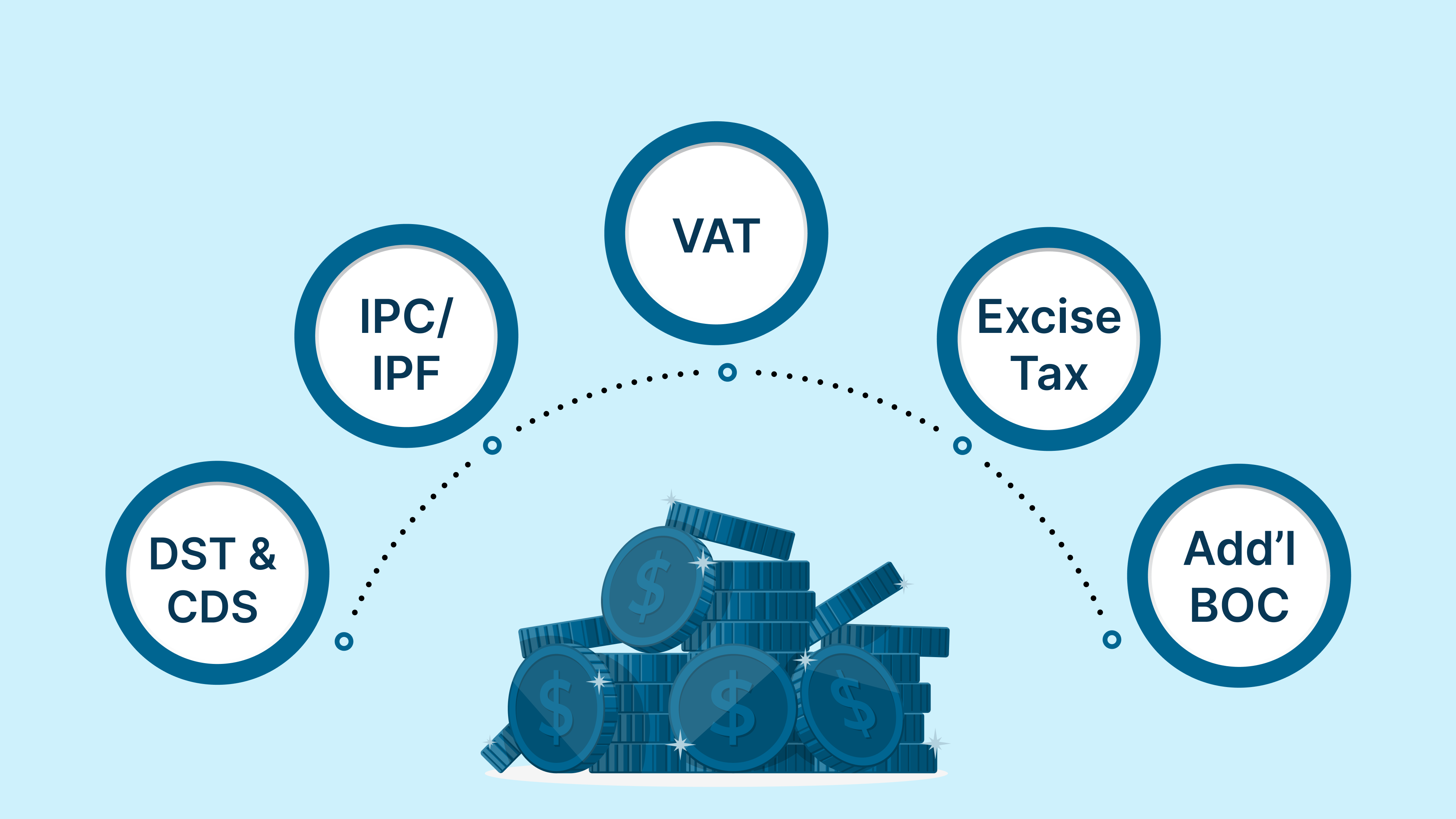

After the assessment, you’ll receive a breakdown of all applicable charges. This typically includes:

You can settle these through Authorized Agent Banks (AABs) or via the BOC’s Electronic Payment Gateway. Payments must be cleared before your shipment can move to the next stage.

After payment is confirmed, customs issues a Release Order through the E2M system. This authorizes the shipment to be moved from the port or bonded facility to its final destination. Depending on your fulfillment setup, your goods are either transferred to a warehouse, routed to a third-party logistics provider, or directly delivered to customers.

To avoid delays at this stage, ensure that any required clearances from partner government agencies (e.g., FDA, DA, DENR) have already been secured. Also, coordinating early with your broker or logistics partner helps streamline pickup and transport from the port, especially for time-sensitive or high-volume shipments.

Inspire Solutions Asia can manage this entire process for you—from document prep to post-clearance logistics.

Contact Us NowNow that the clearance process is underway, let’s review the documents you’ll need to avoid any hiccups.

Also Read: Philippines Post Office Customs Charges Guide

If your business imports or exports, strictly follow customs laws to prevent holds, fines, or legal issues. In the Philippines, customs compliance is governed by several key statutes and administrative issuances that define how goods should be declared, valued, documented, and cleared.

Below are the major legal instruments that guide the customs clearance process:

The CMTA is the primary law governing customs procedures in the Philippines. It modernizes the Bureau of Customs’ systems and aligns Philippine customs policies with international trade standards under the Revised Kyoto Convention. Key provisions cover customs valuation, classification, warehousing, transit, and import/export declarations.

Violations under the CMTA, such as misdeclaration, underdeclaration, or non-compliance with document requirements, can result in administrative fines, forfeiture of goods, or criminal prosecution.

The BOC issues CAOs and CMOs to provide detailed procedures on customs clearance, import valuation, documentation protocols, and importer accreditation. These issuances interpret and enforce provisions of the CMTA.

Each year, new CMOs may update import rules, fees, or documentary requirements. Staying current is critical to ensuring your declarations comply with the latest protocols.

Certain goods require prior clearance from regulatory agencies before they can be legally imported. Common examples include:

4. BIR Tax Identification Number (TIN) and BOC Importer Accreditation

To legally transact with the Bureau of Customs (BOC), importers must have a valid Tax Identification Number (TIN) issued by the Bureau of Internal Revenue (BIR). Importers are also required to secure accreditation directly from the BOC, which verifies their tax compliance using the TIN.

The Certificate of Origin (CO Form D) allows importers to claim preferential tariff rates under the ATIGA for goods imported from ASEAN member countries. If the origin certificate is incorrect or missing, your goods may face full tariffs despite eligibility.

Staying compliant with these laws not only ensures faster customs processing but also protects your business from penalties, cargo holds, and reputational damage. Now, let’s examine how failing to follow customs rules can affect your day-to-day operations and the larger trade flow.

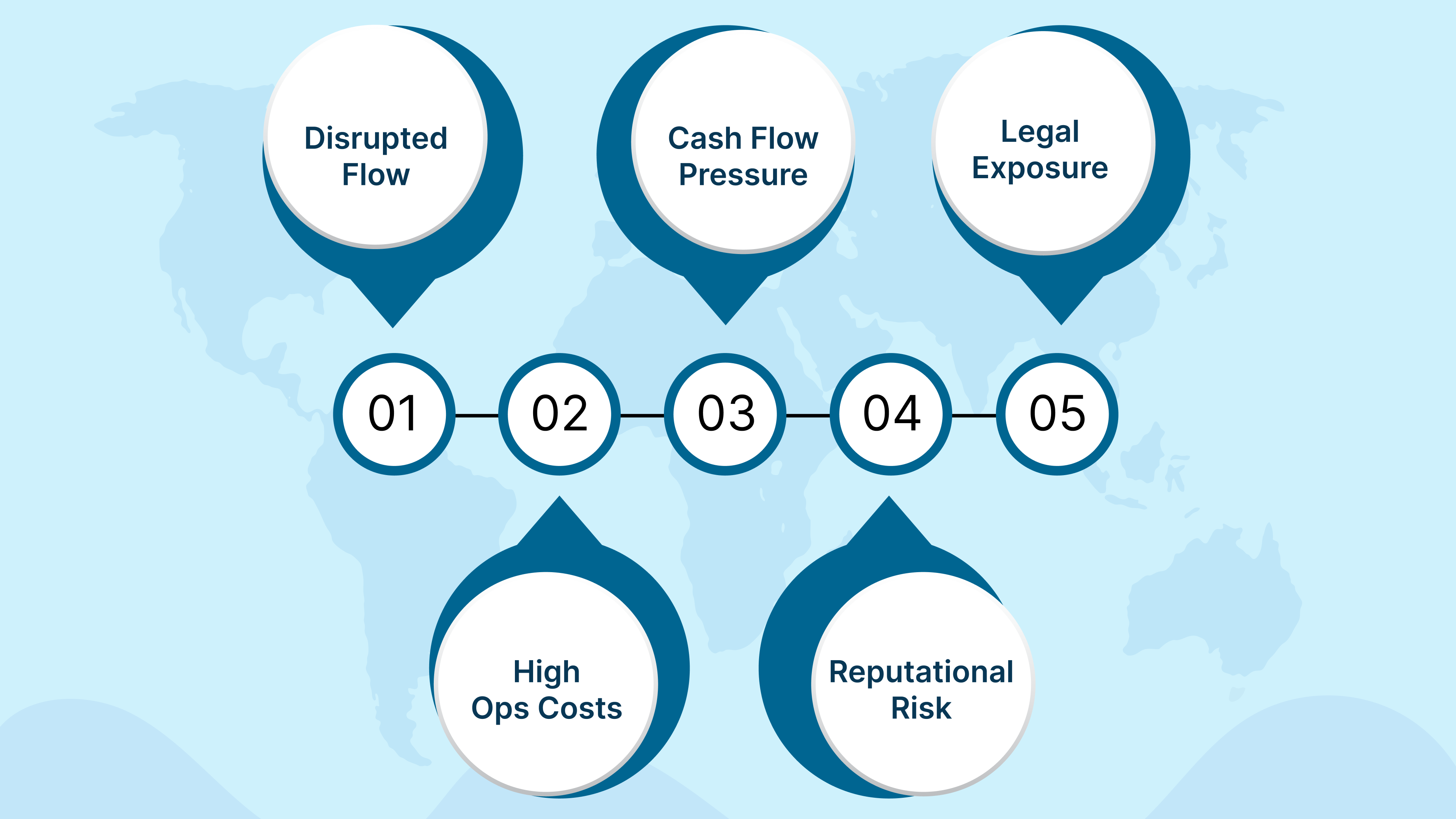

Customs penalties affect you more than a single shipment; they can disrupt an entire supply chain and damage a business’s standing in the Philippine market. For businesses that rely on regular imports to maintain inventory and fulfill customer expectations, even a minor compliance violation can have a ripple effect on internal trade operations.

Here’s how customs-related penalties can affect your business internally:

Penalties often result in shipment holds or the outright seizure of goods, which can delay product availability in your warehouse. This results in gaps in stock levels, delays in customer deliveries, and potential order cancellations, particularly for fast-moving or seasonal items.

Fines, storage fees, demurrage charges, and re-export costs, resulting from non-compliance, directly impact your profit margins. What starts as a documentation oversight can quickly turn into thousands of pesos in avoidable expenses.

Paying unplanned penalties or facing delays in selling your goods affects liquidity. Businesses that operate on tight working capital may struggle to meet their financial obligations, restock inventory, or pay suppliers on time.

Frequent penalties may land you on a BOC watchlist, triggering more scrutiny on future shipments. This slows down your import process and creates long-term friction with logistics partners and brokers.

Customs violations, particularly misdeclaration or underdeclaration, may result in administrative investigations or even criminal prosecution under Philippine customs laws. These issues bring financial consequences and can severely damage your company’s legal position.

Prevent internal trade disruptions by streamlining your customs workflows with Inspire Solutions Asia.

Schedule a call today.Proper documentation is the foundation of any successful import or export transaction. Correct paperwork speeds up customs clearance and shields your business from delays, fines, and compliance troubles.

| Document | Import | Export | Purpose |

| Commercial Invoice | ✓ | ✓ | Specifies the value, quantity, and description of goods |

| Packing List | ✓ | ✓ | Details how goods are packed and organized |

| Bill of Lading / Airway Bill | ✓ | ✓ | Serves as proof of shipment and transport contract |

| Import Permit | ✓ | X | Required for regulated or restricted goods entering the country |

| Export Declaration | X | ✓ | Required to declare goods exiting the country |

| Certificate of Origin | ✓ | ✓ | Verifies where the goods were produced; needed for tariff exemptions |

| BIR Importer’s Accreditation | ✓ | X | Proof of the importer’s legitimacy, required for customs transactions |

| Other Government Permits | ✓ | ✓ | Issued by agencies like the FDA, DA, and DENR for regulated products |

Now that you know what to have on hand, let’s proceed to understand the fees and costs associated with clearing goods through customs in the Philippines.

Also Read: Understanding Customs Clearance: Meaning and Process Guide

When importing goods into the Philippines, customs clearance charges can significantly impact your overall landed cost. These charges cover various government fees, duties, and third-party service expenses tied to processing your shipment through customs. Knowing each cost element helps forecast expenses accurately and prevents margin-impacting financial surprises.

Below is a detailed breakdown of the most common customs clearance charges:

Fees depend on shipment type and value, per 2025 CAO guidelines:

Per CAO and CMO directives:

Knowing these costs in advance helps you budget accurately, set retail prices that protect your margins, and avoid unexpected disruptions in your cash flow.

Customs compliance safeguards operations by preventing penalties, shipment delays, and additional unexpected costs. Minor documentation errors or permit delays can easily disrupt your e-commerce supply chain today.

Customs compliance helps prevent penalties, shipment delays, and surprise costs that can disrupt your entire supply chain. Even minor documentation errors or delayed permits can cause severe delays and harm customer satisfaction in e-commerce. Inspire Solutions Asia offers an integrated system covering sourcing, importation, fulfillment, financing, and last-mile delivery support. This ensures every shipment meets customs and regulatory requirements accurately, avoiding unnecessary delays and additional fees.

If you’re scaling imports or entering new markets, consider sourcing and importation services to reduce customs-related friction. To stay on schedule and serve customers reliably, look into fulfillment solutions built for compliance and efficiency. For improved inventory flow and customs readiness, consider warehousing options designed for high-volume and regulated shipments and same day & next day delivery services.

Stay ahead of compliance challenges and keep your goods moving.

Schedule your consultation todayFees vary but typically include a Documentary Stamp Tax (DST) of PHP 30, Import Processing Charges (PHP 125–PHP 2,000), and 12% VAT on the landed cost.

The de minimis threshold is PHP 10,000, under which goods are generally exempt from duties and taxes.

Major ports include Manila International Container Terminal (MICT), Ninoy Aquino International Airport (NAIA), Cebu International Port, Davao International Port, and Subic Bay Freeport.

It typically takes 1 to 3 days, depending on the shipment’s complexity and documentation.

Ensure accurate documentation, use the E2M system, coordinate with brokers, and secure required permits in advance.