For online retailers, SMEs, and e-commerce managers in the Philippines, timely delivery is essential for customer satisfaction and maintaining competitiveness. However, customs delays can disrupt the shipping process and impact operational efficiency.

According to a Bureau of Customs study, customs-controlled import processing in the Philippines typically takes around 2 days and 7 hours. This processing time may vary depending on various factors, such as documentation and inspections.

The duration customs can hold a package varies. This guide examines the customs process, identifies common causes of delays, and provides strategies for smoother shipping and faster deliveries for e-commerce businesses.

When shipping internationally, one of the most common pain points is managing the customs clearance process. While most e-commerce businesses rely on timely deliveries, customs can sometimes cause unexpected delays. Understanding the usual time customs take to process shipments and identifying common causes of delays can help you set realistic expectations and prevent disruptions in your operations.

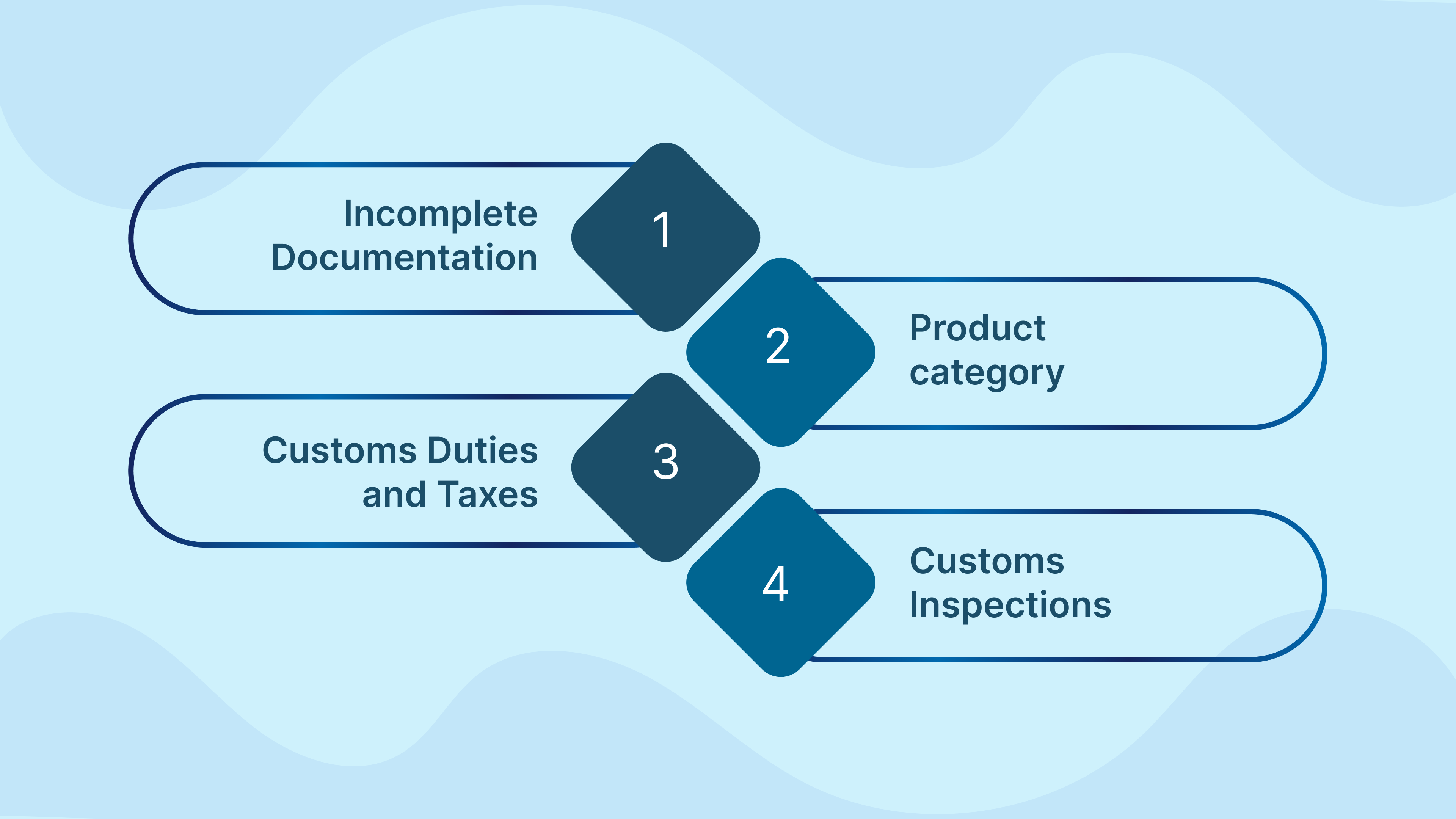

To further enhance your understanding of the customs process, it’s essential to examine the key factors that can impact the duration of your package’s stay in customs. By identifying these elements, you can take steps to minimize delays and manage your shipments. Let’s take a closer look at these factors.

While customs clearance in the Philippines is usually efficient, several key factors can impact how long your package stays in customs. Understanding these variables is crucial to avoid unnecessary delays and ensure timely delivery. Here’s a closer look at the factors that can extend the customs holding time:

Ensuring that all required documents, such as invoices, packing lists, and permits, are complete and accurate can prevent unnecessary holdups and keep your shipments moving smoothly through the clearance process. Required documents include:

If any of these documents are incomplete or inaccurate, customs will hold your package until the issues are resolved. Double-checking and ensuring all paperwork is in order before shipping can help expedite the clearance process.

Specific product categories, such as electronics, pharmaceuticals, and luxury goods, often face extended customs clearance due to their high value, regulatory requirements for safety, or susceptibility to counterfeiting, which necessitate stricter inspections and documentation. For instance:

Being aware of the types of products that might face these challenges allows you to prepare accordingly, ensuring that all necessary documentation and approvals are in place before shipment.

Unpaid or disputed taxes and duties, as well as incorrect product value declarations, commonly cause customs delays by holding packages until these issues are resolved.

To avoid delays, ensure that all duties and taxes are accurately calculated and paid on time. Keeping track of applicable rates and preparing for these costs will help minimize unexpected holdups.

Customs may conduct random inspections, which can delay packages, especially during peak seasons or periods of heightened enforcement. These inspections involve physical checks or additional paperwork verification and are more likely if shipments appear suspicious, contain restricted items, or lack proper documentation.

Ensuring compliance with regulations helps reduce this risk. The World Bank data for 2023 shows that export customs clearance in the Philippines averages 28 days, reflecting comprehensive export activities, which is significantly longer than parcel import processing times.

Minimize customs delays with accurate documentation and proper planning.

Schedule a meeting todayNow that you have a clear understanding of what can impact your customs process, let’s examine practical steps you can take to minimize customs delays and ensure your packages reach their destination without unnecessary holdups.

Also Read: Philippines Post Office Customs Charges Guide

While customs delays are sometimes inevitable, there are several steps you can take to reduce the chances of your package being held up. Here’s a breakdown of key actions you can implement:

The foundation of smooth customs clearance starts with complete and correct documentation. Missing or inaccurate information is one of the leading causes of delays. Here’s what you can do:

Transparency about your products ensures customs can accurately assess compliance and risk, which helps prevent unnecessary inspections and delays. Customs authorities must be aware of exactly what is being imported to ensure compliance with regulations. Here’s how you can stay ahead:

This transparency can help customs process your goods faster and prevent your package from being flagged for additional inspection.

Selecting the right partner can expedite the process, ensuring your shipments meet all regulatory requirements with minimal hassle. When choosing your shipping company:

By relying on experts, you can manage the entire process and significantly reduce delays at customs.

Before goods arrive, ensure all duties and taxes are prepaid to prevent delays in customs clearance caused by unsettled financial obligations.

Taking care of these expenses ahead of time will avoid delays in customs processing, allowing your package to move smoothly through the system.

As you focus on managing your customs clearance process, it’s important to understand that even minor delays can have a significant impact on your business. Let’s now explore how customs delays can affect your business operations and customer relationships.

Need help with managing your customs clearance process?

Contact us today

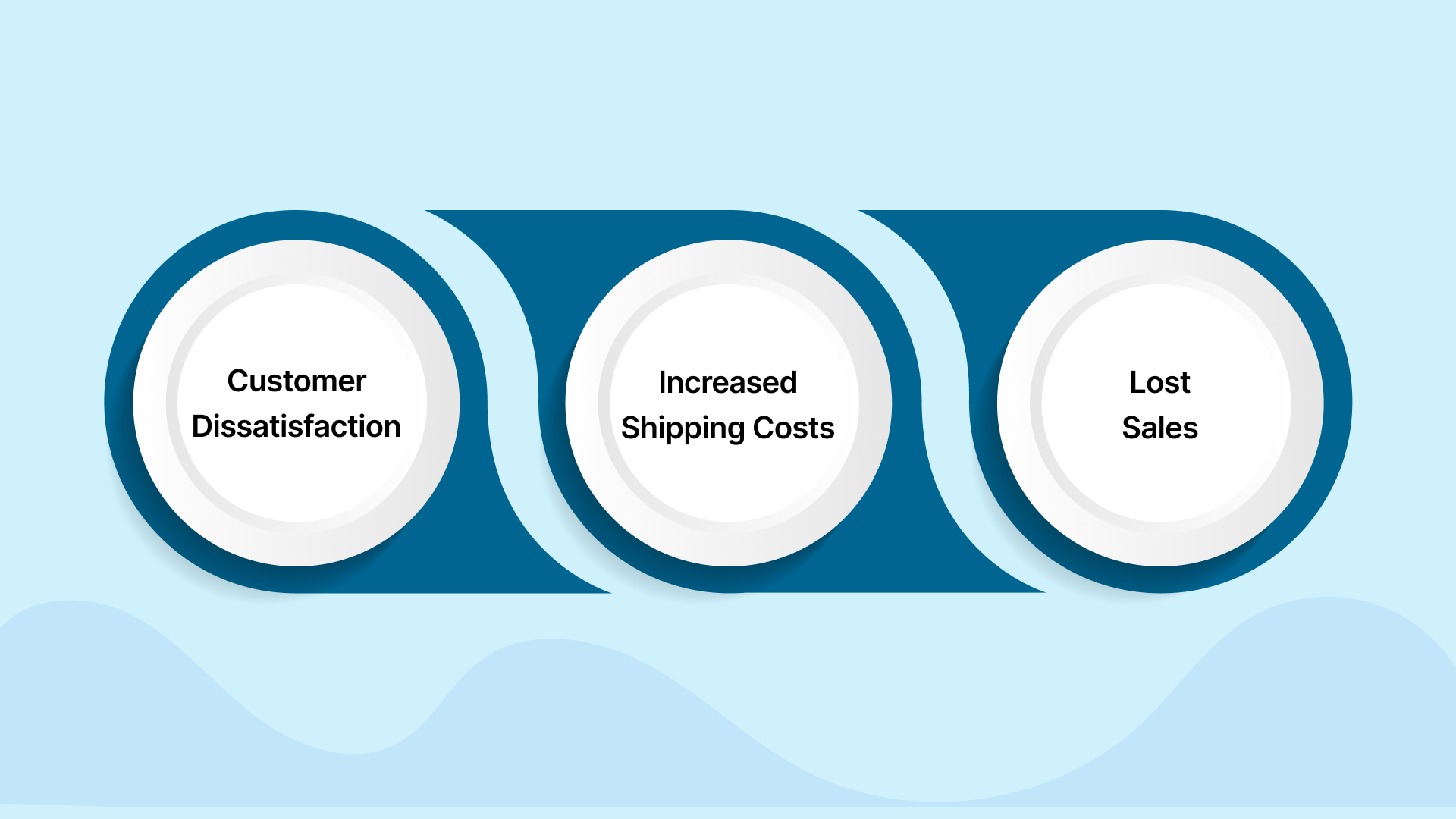

Customs delays, while sometimes unavoidable, can cause ripple effects that harm your business in various ways. Let’s take a look at some of the most common consequences:

One of the most immediate impacts of customs delays is a frustrated customer base. When shipments are delayed, it affects the overall customer experience and satisfaction. Here’s how it can impact you:

Dissatisfied customers might look elsewhere for faster, more reliable service. This can potentially result in a loss of future sales.

When a package is delayed in customs, it often leads to increased costs. Delays at this stage can result in:

This results in unexpected financial burdens that reduce your profit margins and increase operational expenses.

The longer a product takes to reach your customer, the more likely you are to lose the sale. Here’s how customs delays can directly impact sales:

These lost opportunities can directly impact your bottom line, especially when you depend on fast shipping to meet customer expectations.

Also Read: Understanding the Difference Between Logistics and Supply Chain Management

As you work towards enhancing your business operations, minimizing customs delays, and ensuring smooth deliveries, Inspire Solutions Asia offers a range of services tailored to address the challenges you face. From streamlined customs clearance to fast, reliable deliveries, we support businesses in overcoming logistical hurdles. Here’s how our services can benefit you:

Ready to smooth your customs process and ensure timely delivery?

Get a quote today.Understanding customs processes and taking proactive steps to avoid delays is essential for the success of your business. By ensuring accurate documentation, being transparent about your products, and collaborating with reliable partners, you can minimize the risk of customs-related delays, thereby enhancing your logistics efficiency and customer satisfaction. Following these steps will ensure smoother shipping and help establish a better reputation for your business, allowing you to focus on growth and scalability.

At Inspire Solutions Asia, we understand the importance of streamlined operations. Our integrated services, from sourcing and importation to last-mile delivery, ensure your shipments reach their destination on time while keeping your business compliant with customs regulations.

Learn how we can optimize your logistics and reduce customs delays, improving delivery timelines and customer satisfaction.

Schedule a meeting todayCustoms delays in the Philippines can be caused by several factors, including:

To avoid customs delays:

Customs delays can have several negative effects:

On average, customs-controlled import processing in the Philippines takes about 2 days and 7 hours. However, this can vary depending on the type of product, the accuracy of documentation, and whether random inspections are conducted. High-risk items like electronics or pharmaceuticals may take longer due to stricter regulations and additional checks.

Working with a customs broker offers several advantages: