How do you ensure that your shipments clear customs without unnecessary delays and extra costs? When importing goods to or from the Philippines, understanding post office customs charges is essential to avoid unexpected costs and ensure smooth customs clearance. Whether you’re shipping for personal use or business, customs duties, taxes, and additional fees are part of the process. Knowing how to calculate these charges and understanding the factors involved can help you manage your shipping costs effectively.

In this guide, we will explore everything you need to know about Philippines Post Office Customs Charges, including how to calculate taxes and duties, the different types of import taxes, and the necessary documents and payment processes.

As per the Philippines Customs Law, all imported goods coming into the country are subject to duties, taxes, and other local charges. The Bureau of Customs (BOC) is responsible for enforcing these laws and collecting customs duties, VAT, and other applicable fees. Import taxes and duties are calculated based on the total landed cost of the shipment.

Importing goods without paying the required taxes and duties will result in delays and prevent the release of the goods.

Also Read: Understanding Logistics Services: Types and Benefits

With the basics of import taxes and duties covered, it’s essential to understand how these charges are calculated and how you can prepare for them.

When calculating post office customs charges, several factors come into play. Below are key elements to consider:

This comprehensive approach ensures that all aspects of the shipment are factored into the customs charges.

Now that we understand how post office customs charges are calculated, let’s dive deeper into the different tax types applied to imported goods.

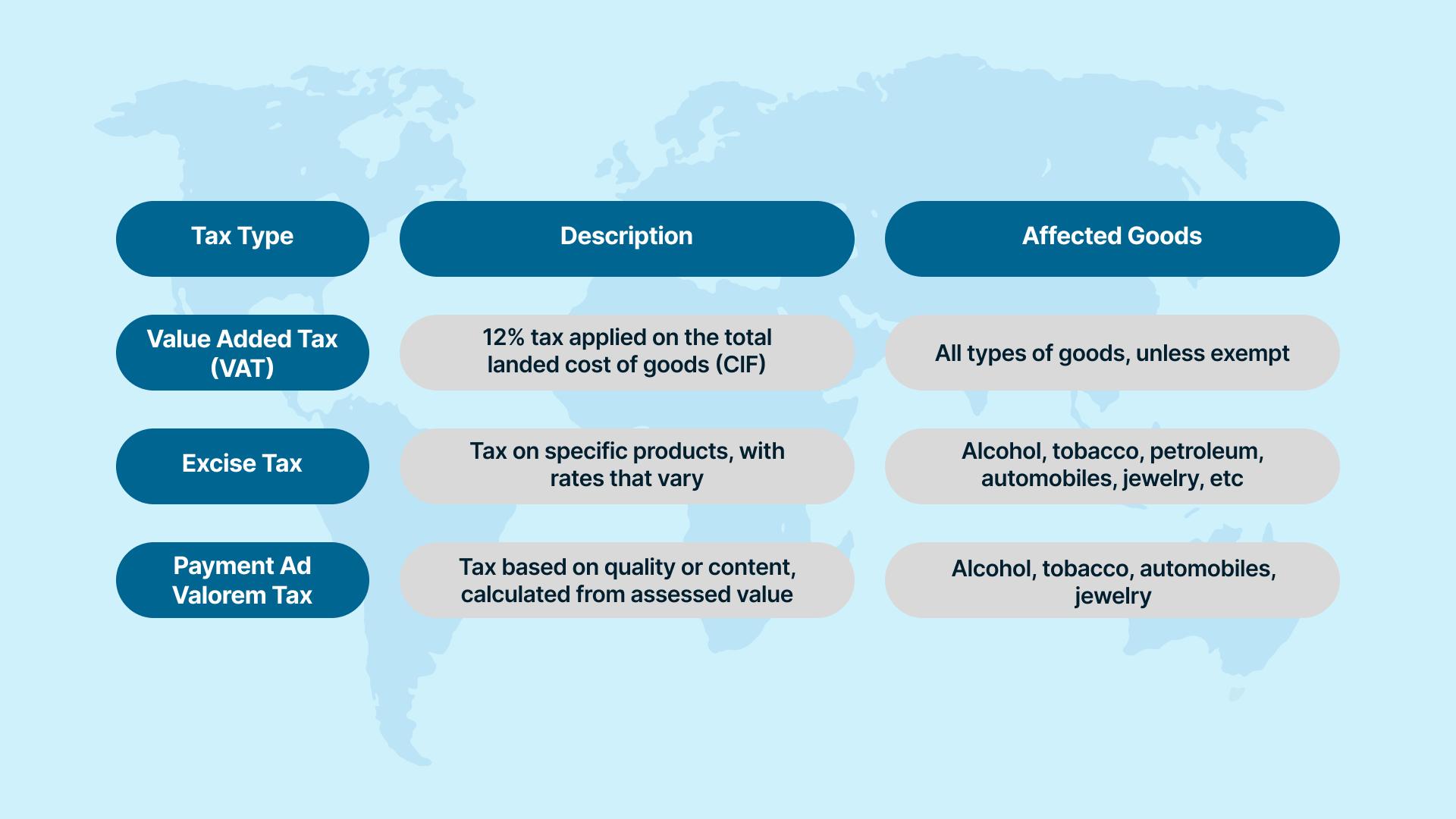

The Philippines applies several types of taxes to imported goods, depending on the category and the nature of the goods being shipped. Here’s an overview of the primary taxes:

| Tax Type | Description | Affected Goods |

|---|---|---|

| Value Added Tax (VAT) | A 12% tax applied on the total landed cost of goods (CIF). | All types of goods, unless exempt. |

| Excise Tax | A tax on specific products, with rates that vary depending on the commodity. | Alcohol, tobacco, petroleum, automobiles, jewelry, etc. |

| Payment Ad Valorem Tax | A tax based on the quality or content of goods, calculated from the assessed value. | Alcohol, tobacco, automobiles, jewelry. |

When planning to ship goods into the Philippines, there are a few other essential factors that need to be considered in addition to the primary tax types:

These considerations not only facilitate the accurate calculation of taxes for your specific shipment into the Philippines but also help prevent potential delays or penalties when your goods go through customs clearance.

In addition to the primary duties and taxes, several other fees may apply to shipments entering the Philippines:

These additional costs can significantly increase your shipping expenses, so it’s essential to account for them when planning your shipment.

Also Read: CBM Meaning in Shipping Explained

With a clear understanding of the fees and tax types, it’s important to ensure your goods are properly declared to avoid delays and legal consequences.

Accurate declaration of your shipment’s value and contents is crucial for avoiding delays and penalties. It is illegal to undervalue goods to reduce import taxes. Undervaluing can result in:

Always ensure that you provide accurate and detailed information about your shipment to ensure a smooth customs clearance process.

With accurate declarations in mind, let’s now look at how the CIF method affects the calculation of duty and VAT for your imports.

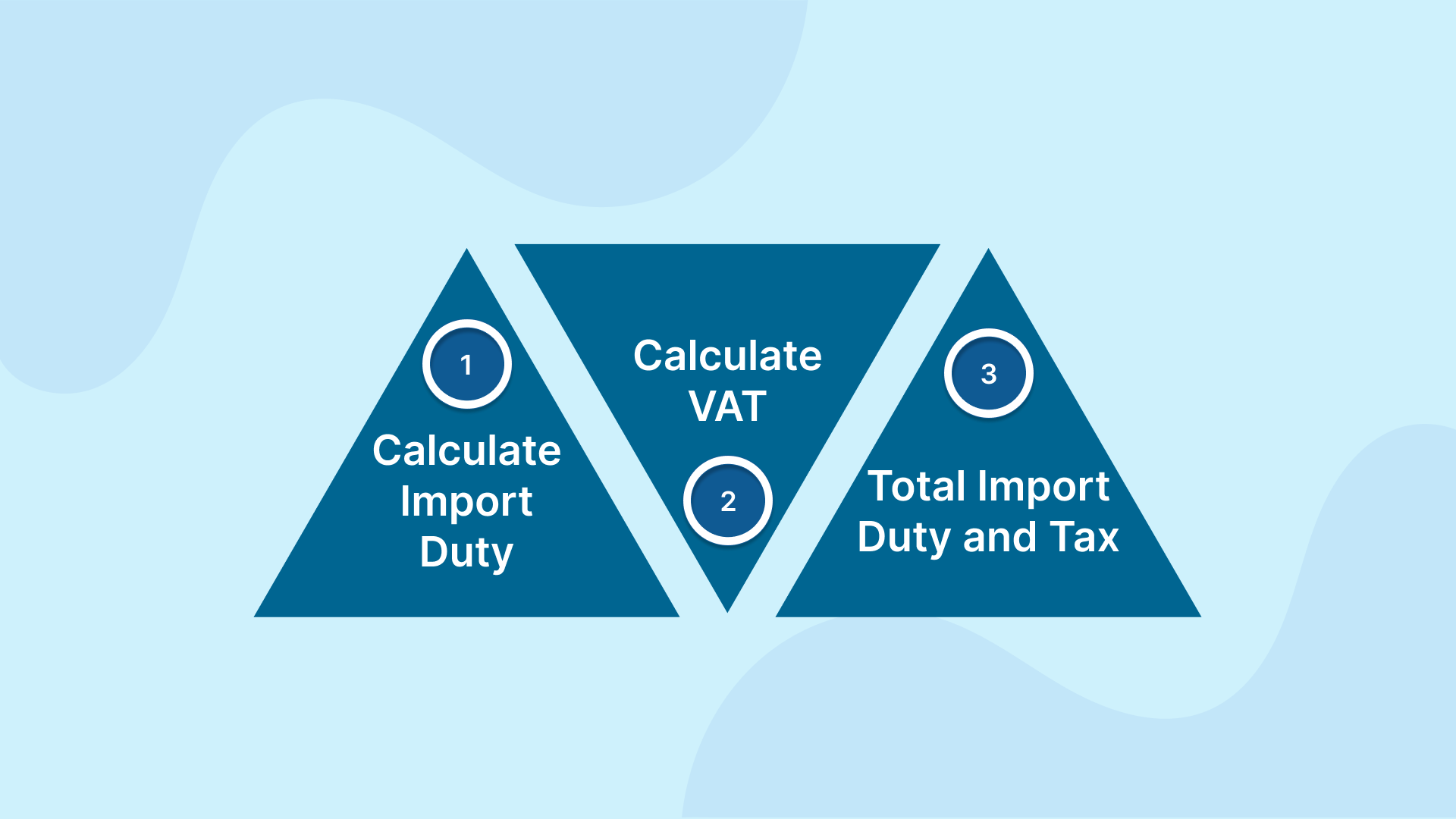

The calculation of import duty and VAT is based on the CIF value—the total cost of the goods, including shipping and insurance. Here’s how the calculation works:

Here’s an example of how to calculate the import duty and VAT:

Import Duty = 5% of PHP 1,000,000 = PHP 50,000

VAT = 12% of (PHP 1,000,000 + PHP 50,000) = PHP 126,000

Total Import Duty and Tax = PHP 50,000 + PHP 126,000 = PHP 176,000

With a clear understanding of how to calculate duties and taxes, it’s important to stay informed about changes in import tax laws and tariffs that may affect your shipment.

It’s important to stay informed about changes in import tax laws in the Philippines, as these can affect the overall cost of your shipment. In an important mandate, tariffs have been removed on approximately 99% of goods from ASEAN trading partners due to the ASEAN Trade in Goods Agreement (ATIGA). This makes importing goods from ASEAN countries more affordable, as many items are now exempt from tariffs.

Additionally, import tariffs for certain products, especially those that compete with local industries, may still be high. For example, manufactured goods may be subject to higher duties compared to goods with minimal local competition.

Experience swift and dependable delivery for your customers with Inspire SolutionsAsia’s Same Day and Next Day services. We offer SameDay delivery in Metro Manila and select nearby locations, along with NextDay delivery to various provinces throughout the Philippines. Contact us today to discover how we can streamline your delivery process and ensure your products arrive punctually.

Understanding how to navigate these changing tariffs is crucial. Now, let’s see how Inspire Solutions Asia can help you streamline your logistics and customs clearance processes.

At Inspire Solutions Asia, we recognize that managing the complexities of customs charges and logistics can be overwhelming, especially when shipping internationally. Our integrated solutions make it easier to navigate the customs clearance process, reduce costs, and optimize shipping for your business.

Here’s how we can help you manage your shipping needs:

In line with our expertise in logistics and shipping, we can help you navigate post office customs charges efficiently, reduce operational costs, and ensure timely delivery. Want to streamline your import processes and minimize customs-related expenses? Contact Inspire Solutions Asia today to learn how our tailored logistics solutions can optimize your shipping operations and improve your bottom line.

Navigating post office customs charges in the Philippines can be complicated, but understanding the CIF method, the de minimis threshold, tax types, and required documentation is crucial. By accurately declaring your goods and staying informed about the various taxes and duties that apply, you can avoid delays, reduce unexpected costs, and ensure smooth customs clearance.

At Inspire Solutions Asia, we focus on making logistics easier with tailored warehousing, fulfillment, and shipping services. Our knowledge and experience enable businesses to reduce costs and enhance operational efficiency, guaranteeing a smooth supply chain experience.

Allow us to handle your shipping requirements in a way that best aligns with your business goals. Contact us for consultations, demonstrations, or additional information about what we offer.